trend of China’s smart door lock industry In 2024

Smart Door Locks: A New Trend in Security Solutions

A smart door lock is an advanced locking system that integrates electronic, mechanical, and network technologies to enhance security, convenience, and intelligence. As a key component in modern access control systems, it plays a crucial role in ensuring safety while offering seamless and user-friendly access management.

With the rise of smart technology and digitalization, consumer expectations for door locks have evolved, demanding more electronic and information-driven solutions. This shift has positioned smart locks as a key trend in the security industry, presenting new opportunities for manufacturers and enterprises specializing in safety doors.

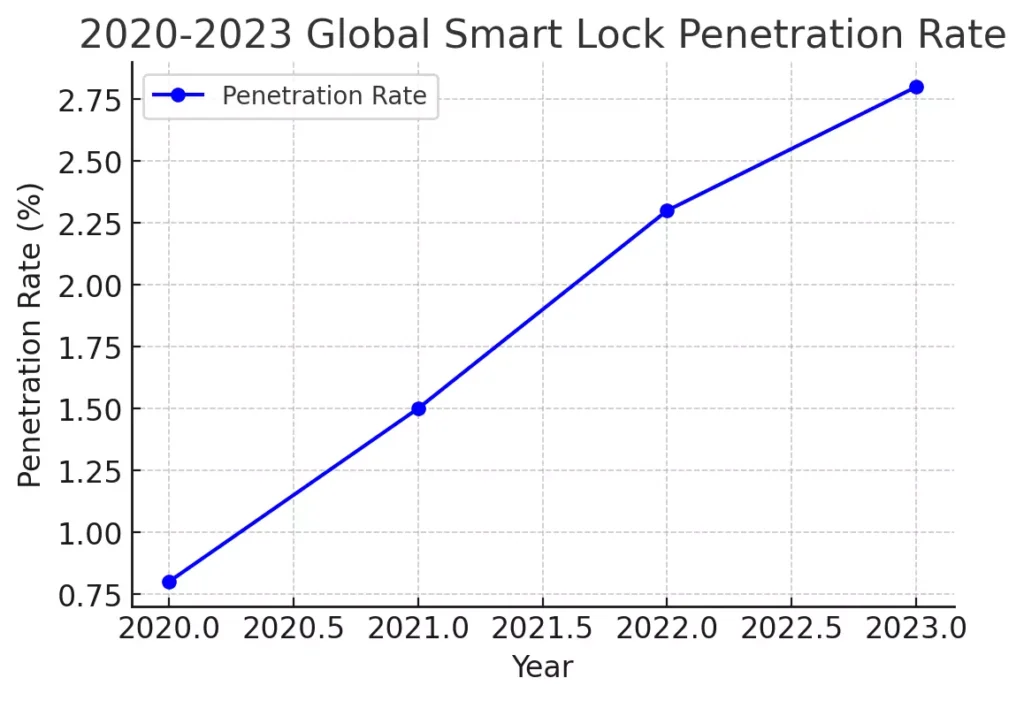

Despite their increasing popularity, smart door locks have yet to achieve widespread adoption globally, with a penetration rate of just 2.8% in 2023. However, as technology continues to advance and consumer awareness grows, the market for smart locks is expected to expand significantly, paving the way for a smarter, more secure future.

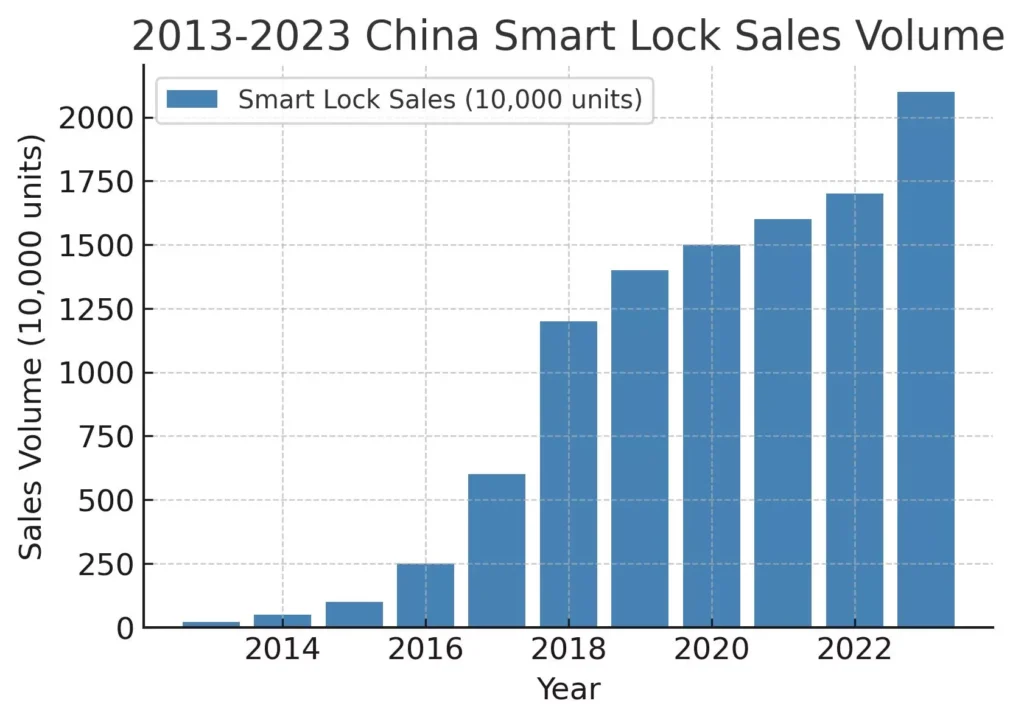

The smart lock industry in China has been developing since the early 21st century and has entered a period of rapid growth after years of development. In 2013, the production and sales volume of smart door locks in China was only 900000 units, and by 2023, the sales volume will expand to 22.3 million sets. In the future, with continuous support from national policies and changes in consumer attitudes, the acceptance of smart locks will further increase, market demand will continue to increase, and the overall production and sales volume of the industry will further expand.

After years of market competition and survival of the fittest, the smart door lock industry has gradually evolved into three dominant player groups:

Professional Smart Lock Brands

Companies like Kaidi Shi and Deshman lead this segment with strong product innovation and technical expertise. These brands possess substantial market influence, particularly in pricing, thanks to their deep-rooted industry experience and cutting-edge R&D capabilities.

Traditional Home Appliance Brands

Established players like Haier Smart Home and TCL capitalize on their existing brand reputation, extensive distribution networks, and well-developed service systems. While entering the market later than others, these brands benefit from their established consumer trust and sales channels, giving them a significant latecomer advantage.

Internet Giants

Tech giants such as Xiaomi and Huawei leverage their extensive smart home ecosystems and technological synergies to gain a strong foothold in the smart lock industry. Their integration of smart locks into IoT-driven ecosystems gives them a unique competitive edge in connectivity and user experience.

Despite increasing competition, traditional brands continue to hold a dominant position in the smart door lock sector. In 2023, they accounted for 57% of the market share, demonstrating their technological edge, brand trust, and market influence.

1、 Industrial chain

Smart door lock is a type of lock that combines electronic technology, mechanical technology, and network technology. It has the characteristics of intelligence, convenience, and security, and is the executing component for locking doors in access control systems. From the perspective of the industrial chain, the coordinated development of the upper, middle, and lower industrial chains of smart door locks. Among them, the upstream industrial chain consists of hardware, technology suppliers, and solution providers, with raw materials including chips, batteries, stainless steel, display screens, etc. The downstream includes various sales channels, including engineering channels, door distribution, offline retail, and online e-commerce.

2、 Market situation

Global market penetration rate

With the development of social intelligence and informatization, consumers have also put forward electronic and information-based requirements for door locks. The application of intelligent locks has become a new trend in the development of safety doors today, and it is also a new opportunity for the development of safety door enterprises.

At present, the global penetration rate of smart door locks is not high, only 2.8% in 2023. By region, South Korea has the highest penetration rate, reaching 80%; Europe, America, and Japan are both at 35% to 40%. A large number of developing countries and regions are within 5%.

In the future, as global consumers increasingly value digital security, their dependence on smart products will become higher, and the penetration rate of smart door locks will continue to increase.

Sales volume in the Chinese market

The smart lock industry in China has been developing since the early 21st century and has entered a period of rapid growth after many years of development. Due to its convenience and strong sense of technology, the door accessories market has continued to make efforts, and a large number of door manufacturers have replaced traditional mechanical locks with smart locks.

With the rise of modern real estate industry in China, high-end residential communities and villas are rapidly developing. More and more commercial residential properties are willing to install intelligent anti-theft locks to improve the quality of the community and increase security measures.

In addition, consumers are also adopting smart door locks to improve the convenience and intelligence of their lives, and are making efforts through multiple channels to drive the continuous expansion of sales of smart door locks. In 2013, the production and sales volume of smart door locks in China was only 900000 units, and by 2023, the sales volume will expand to 22.3 million sets.

In the future, with continuous support from national policies and changes in consumer attitudes, the acceptance of smart locks will further increase, market demand will continue to increase, and the overall production and sales volume of the industry will further expand.

Sales of smart door locks in China from 2013 to 2023

The production of smart door locks in our country mainly follows the development of economy, electronics, supporting facilities, and hardware, and has initially formed industrial clusters in several regions, with obvious industry cluster effects. Among them, the Yongwu cluster, Xiaolan cluster, Wenzhou cluster, and Guangfo cluster have the largest scale, accounting for 94% of China’s production. The Yongwu cluster and Xiaolan cluster both account for over 30%.

Proportion of China’s smart door lock industry cluster in 2023

In terms of output value, from 2013 to 2023, the total output value of smart door locks in China doubled. As the boundary point for the rapid development of the smart door lock industry in 2018, the industry has entered a fast lane of growth, with the total output value increasing from 10.8 billion yuan to nearly 18 billion yuan from 2018 to 2023.

Total output value of smart door locks in China from 2013 to 2023

Smart door locks mainly use human biometric comparison to identify identities, including facial recognition, fingerprint recognition, vein recognition, palm recognition, and iris recognition. For smart door lock products, technological innovation and development are important factors in product popularization. Consumers not only pay attention to price, but also have a high level of concern for product quality and safety.

Face recognition and fingerprint recognition, two more secure unlocking methods, are more favored by consumers. Fingerprint recognition applications have a nearly 100% market share, and the security of facial recognition technology is gradually being guaranteed. It has also become one of the standard configurations for smart door locks, especially in fully automatic high-end products.

Facial recognition also has strong advantages, with an application rate of over 60%. In addition, vein recognition technology is becoming a trend track. It has advantages such as higher precision, higher stability, and higher security. At present, the main technological routes refer to veins and palmar veins. Due to factors such as cost and power consumption, the penetration rate of vein recognition door locks is relatively low. However, mainstream brands are accelerating their layout in the vein recognition market. In 2024, vein recognition will continue to be one of the main areas of exploration and innovation for corporate brands.

price trend

According to online monitoring data from Luotu Technology, the average online market price for smart door locks in China will be 1147 yuan in 2023, a year-on-year decrease of 138 yuan; Among them, the average price dropped to 981 yuan in August 2023, and for the first time in nearly three years, the monthly average price fell below 1000 yuan. The sales share of the price range below 1000 yuan reached 58.2%, making it the mainstream price range in the online market for smart door locks.

This is mainly due to the intensification of market competition, which has led to the continuous escalation of price wars; On the other hand, the new entrants in the smart door lock industry in 2023 are mostly small and medium-sized brands, mainly promoting products priced below 1000 yuan, hoping to achieve rapid conversion through a single explosive product.

Competitive landscape

With more and more enterprises entering the field of smart door locks and the market saturation gradually increasing, industry competition is becoming increasingly fierce, and the industry is entering a fierce reshuffle period. The number of enterprises has decreased from over 2000 in 2018 to around 1000 in 2022. After several years of survival of the fittest, the smart door lock market has gradually formed three mainstream player camps: the first is professional smart lock brands represented by Kaidi Shi and Deshman, which have rich product and technical strength and control certain market pricing power;

The second is the Internet companies represented by Xiaomi, Huawei and others. They rely on their own ecological advantages to form their own ecosystems and have synergy advantages; The third type is traditional home appliance brands represented by players such as Haier Smart Home and TCL, which have ready-made brands, channels, and service systems, and have opportunities for latecomers. In addition, there are also traditional lock companies such as Wangli Group and Yale, emerging Internet brands such as Luke and Guojia, and smart security companies such as Fluor and Tianneng.

From the perspective of market share of various types of brands, traditional brands still have a significant competitive advantage in the field of smart door locks based on their technological and brand advantages, occupying 57% of the market share in 2023. Cross border brands and emerging brands account for 24% and 15% respectively. The boundaries between cross-border brands, emerging brands, and traditional brands are becoming increasingly blurred. With increasingly fierce market competition, small and medium-sized enterprises will face greater challenges and pressures in the future.

Future Trends

The sales proportion of smart door locks in emerging e-commerce will further increase

With the development of Internet technology and the expansion of online shopping users, e-commerce channels have become a must for intelligent door lock enterprises in the new era. In the future, various brands will accelerate the layout of emerging e-commerce channels such as live streaming sales and social e-commerce, while using content marketing to expand their audience and enhance their influence. In the future, the sales proportion of smart door locks in emerging e-commerce will further increase.

Manufacturers actively layout overseas markets

There are numerous players in the current domestic market, and the industry competition is extremely fierce. The price war has led to a continuous compression of profit margins, and some brands have fallen into a prisoner’s dilemma in their development. At the same time, the penetration rate of smart door locks in many overseas regions is relatively low, and the product function design is one to two generations behind that in China. This is a great opportunity for brands that have been fully baptized in the domestic market. In the future, domestic manufacturers will focus on overseas markets and accelerate their pace of going global.

AI technology supports product innovation

Since 2023, the rapid development of AI models has brought new technological ideas to smart door locks. The application of large-scale models has advantages in fingerprint recognition accuracy, image visual recognition, advanced reasoning, and has strong self-learning and adaptability, further improving the speed, accuracy, and safety of intelligent door lock recognition, and promoting the development of intelligent door locks towards safer, more convenient, and intelligent directions.

Since 2024, new products launched by brands such as Deshmann, Huawei, and Fluorite have all been supported by AI technology. For example, Deshmann has released the new GPT finger, which applies GPT technology to the fingerprint recognition function of smart locks. In the future, AI technology will be more applied to smart door locks, further promoting innovation and development of smart door locks, and enhancing user experience, bringing more possibilities and opportunities for smart door locks.