Q1 2024 Smart Lock Surge: Unpacking a Powerful Booming Market

The Chinese household smart lock industry is booming.

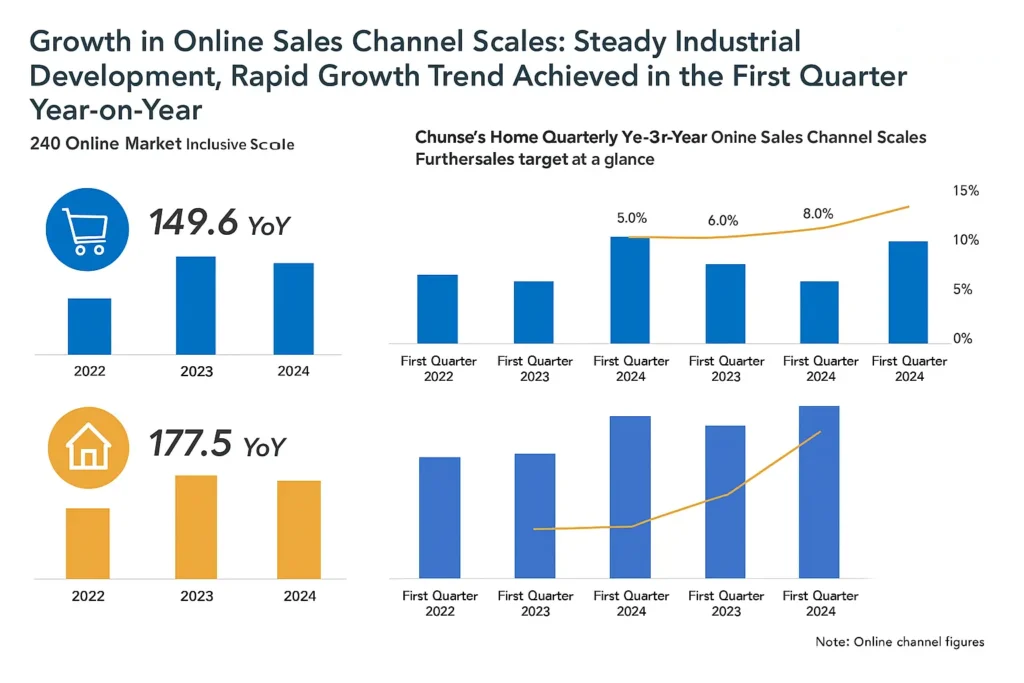

The industry is in a rapid development golden period, with steady market growth. Total data shows that in the first quarter of 2024, the online retail volume of Chinese household smart locks reached 1.496 million sets, a year-on-year increase of 24.5%; the retail sales volume reached 1.51 billion yuan, a year-on-year increase of 24.8%.

Growth has external drivers, and this growth is not accidental or unordered; it has clear external driving forces and internal logic.

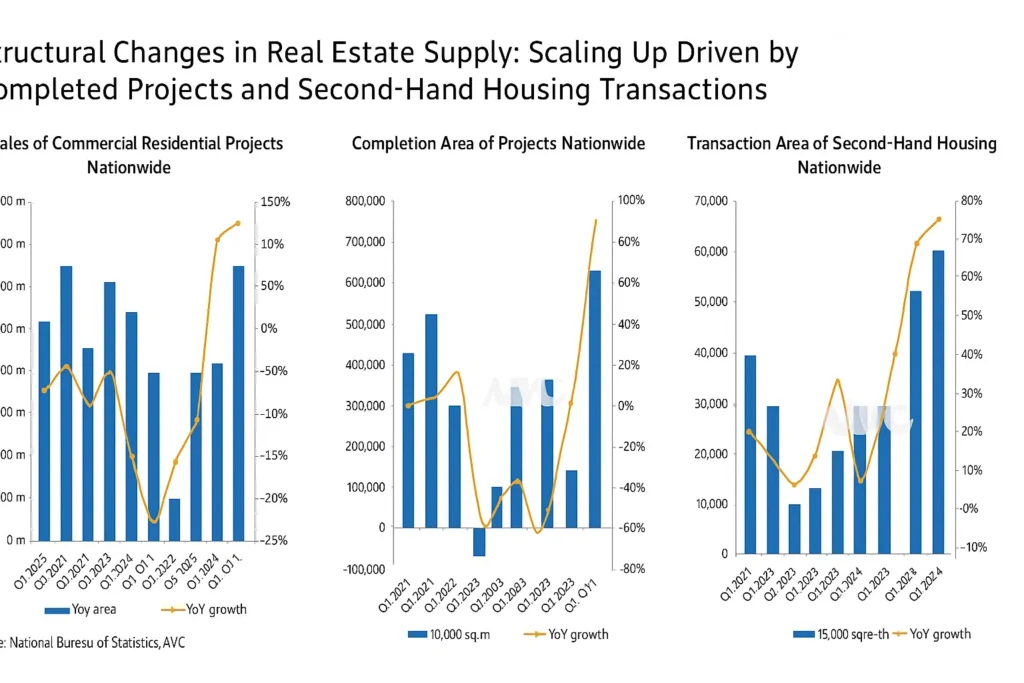

First of all, at the real estate level, the decline in new home transactions in 2023 has slowed down, and the growth in the delivery area of residential buildings nationwide is positive. The transaction scale of the second-hand housing market has increased significantly, driving the market share of second-hand housing to rise. Data shows that in 2023, second-hand housing transactions accounted for 37% of the overall market, a year-on-year increase of 44%. The rise in the scale of second-hand housing transactions will drive downstream consumption, and from the demand perspective, it will have a certain positive impact on the smart lock industry.

Also, with the development of technologies such as the Internet of Things, cloud computing, artificial intelligence, and biometric identification, and the accelerated construction of smart homes and smart cities, the intelligence level of smart locks has been greatly improved, allowing them to better integrate into the family smart ecosystem and further meet consumers’ needs for high-quality, safe, and convenient lives.

At the same time, as an extension of cashless and keyless living, smart locks align with the fast-paced, digital lifestyle of modern society. The evolution of technological progress, market demand, and social lifestyle has provided broad space and strong momentum for the development of the Chinese household smart lock industry. Growth has internal logic, and the self-revolution and upgrading within the industry are also continuously injecting vitality into the prosperity of the Chinese smart lock market. Affordable prices promote growth In the Chinese household smart lock industry, a reasonable price positioning is one of the keys to attracting consumers and expanding market share.

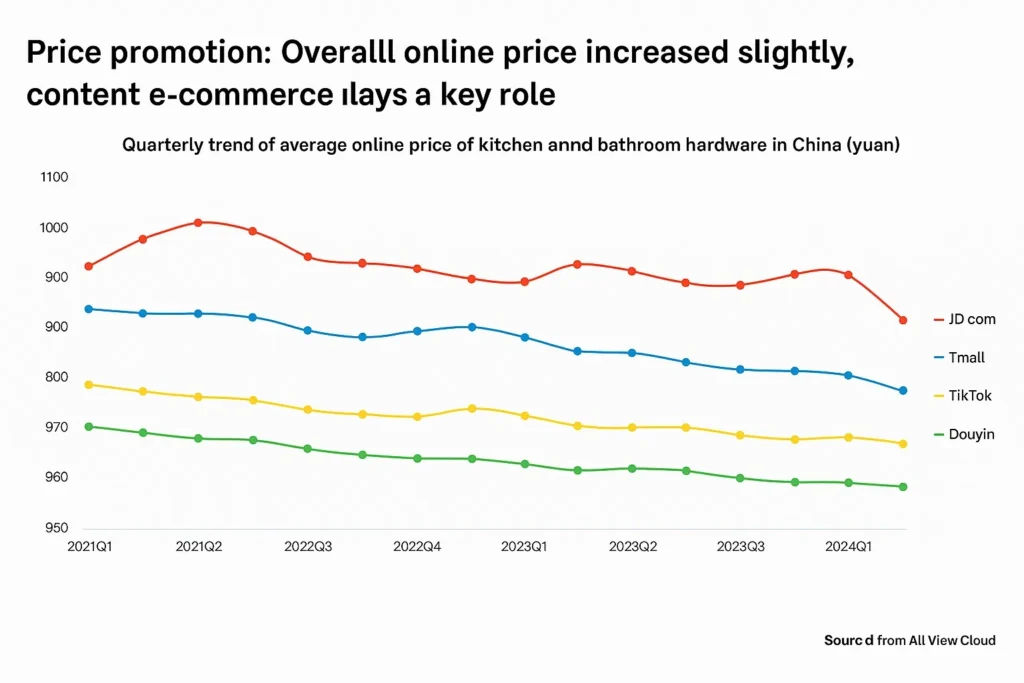

Data shows that in the first quarter of 2024, the average price of the online market for household smart locks in China (including professional e-commerce, platform e-commerce, and content e-commerce, the same below) was 992 yuan, entering the sub-thousand yuan range, a year-on-year increase of 2.0%. The key reason for the growth is the structural optimization of content e-commerce. With the increasing maturity of smart door lock-related technologies and the cost reduction effect brought by mass production, new smart door lock products have entered the market at more affordable prices, lowering the threshold for consumers to try and adopt new technology products, thereby attracting more potential consumers.

Among them, the average price reduction trend of facial recognition and vein recognition products is relatively more significant. Diversified channels leading to growth Diversified channel layout is also one of the key strategies for expanding the scale of the household smart door lock industry in China. Professional e-commerce plays an important role in promoting the retail volume growth of smart door locks, aiming to increase the market penetration rate of household smart locks in China.

Platform e-commerce focuses on the synchronous growth of products in different price segments (low, medium, and high), promoting the popularization of entry-level products while strengthening the market share of mid-to-high-end products, to meet the diverse and multi-level consumer needs in the market. Content e-commerce, as a new channel, is rapidly growing.

Through vivid and interesting content marketing, live streaming, and other methods, it attracts consumers, effectively driving the scale growth of the online market. Data shows that in the first quarter of 2024, the retail volume scale of content e-commerce grew by 20% year-on-year, and with the help of its product structure optimization, the retail revenue scale grew by 52%. Technological innovation drives growth The continuous iteration and innovation of new technology products are one of the core driving forces behind the growth of the household smart door lock market in China.

In the first quarter of 2024, the market penetration rate of new technology products in online traditional e-commerce (professional e-commerce + platform e-commerce, the same below) continued to rise. Among them, the retail volume share of Mafeng large screen products was 28.6%, an increase of 4.8 percentage points compared to the previous year; the retail revenue share reached 40.0%, an increase of 10.7 percentage points compared to the previous year. The retail volume share of facial recognition products was 27.0%, an increase of 6.9 percentage points; the retail revenue share was 37.3%, an increase of 11.3 percentage points. Vein recognition products currently have a low penetration rate, but in terms of the magnitude of scale growth, the market space is large.

In the first quarter of 2024, the retail volume share of finger vein and palm vein products was 4.6% and 1.4% respectively, and the retail revenue share was 7.7% and 4.4% respectively. With the development of the household smart door lock industry in China, the market share of products with multiple technologies and functions is becoming increasingly high.

This is mainly because different technology combinations can meet the refined needs of different customer groups, providing one-stop solutions that simplify user operations. Consumers can choose suitable product functions based on their preferences and actual needs. Multi-technology integration means multiple layers of security protection, enhancing users’ sense of security, and the product offers higher cost performance, thus increasing market acceptance. Data shows that in the first quarter of 2024, in the traditional e-commerce channel technology combination, the product with “Mafeng + large screen + facial recognition” function ranked first in sales, accounting for 17.6%, an increase of 4.1 percentage points compared to the previous year.

While the focus of technical combinations varies across different price segments, and the higher the price segment, the higher the retail volume share of products with these combinations. In the market of 3,000 yuan and above, the ranking of fingerprint vein and palm vein technology combinations with high-end attributes has improved. For example, products with functions such as “cat eye + large screen + facial recognition + palm vein” have a retail volume share of 18.4% in the 3,000-3,499 yuan market and reach 57.1% in the 3,500-3,999 yuan market.

Moreover, since the beginning of 2024, the Chinese home smart lock industry has seen an increasing number of multi-camera designs and products deeply integrated with AI, further enhancing the security, convenience, and intelligence of smart locks.

It further explains that in the current fierce competition, enhancing the core competitiveness of products is a crucial strategy to secure a favorable position in the market. Marketing communication enables growth. In addition to price, channels, and technology driving scale growth, marketing communication is equally important. Users are often attracted to content with storytelling, resonance, or problem-solving qualities, creating a desire to share and further sparking topic discussions, thereby increasing exposure. Therefore, smart lock brands need to combine high-quality content with suitable influencers, skillfully incorporating product information to enhance content influence and spread, achieving the goals of shaping brand image, conveying product advantages, and promoting conversions.

This signals that the Chinese home smart lock industry has matured into a dynamic arena of comprehensive competition, fiercely contested across price, technology, distribution channels, and marketing strategies. To achieve sustainable and stable growth, brands must demonstrate agility and responsiveness. Indeed, development within this competitive landscape is proving to be remarkably structured. Throughout the evolution of China’s home smart lock industry, there has been a continuous influx of enterprises, all actively engaging and investing substantially in technological research and development, iterative product enhancements, and strategic market expansion.

Each enterprise competes for market share through differentiated market positioning, channel expansion, and brand marketing strategies, which has, to some extent, promoted the normalization and orderliness of market competition. Data shows that in the first quarter of 2024, the combined share of the top 10 brands in terms of online retail sales reached 68.1%, and the combined share of the top 10 brands in terms of retail volume reached 55.6%.

Among them: Desman: In the first quarter of 2024 online market (professional e-commerce + platform e-commerce + content e-commerce), Desman ranked first with an 18% retail volume share, an increase of 3 percentage points compared to the first quarter of 2023. In the 2,500 yuan and above market, Desman ranked first with a 24% retail volume share, demonstrating Desman’s strong high-end competitive strength.

At the 2024 Desman global new product launch event, the company introduced three breakthrough technologies: “GPTfinger,” “Longting Motor,” and “D-Power Smart Power Supply System,” along with several flagship new products, further consolidating Desman’s leading position in the high-end market. This also further indicates that Desman will lead and create the “AI+” trend in smart locks, moving towards an evolutionary path driven by technological innovation, continuously providing users with more reliable and secure experiences.

LUKU: Focuses on the mid-to-high-end market and holds a leading position in the vein lock field. In the first quarter of 2024, in the traditional e-commerce (professional e-commerce + platform e-commerce) market of 2500 yuan and above, LUKU’s retail sales and retail volume share are both ranked first, reaching 25% and 24% respectively, with significant advantages. In 2024, LUKU pioneered a new generation of “fingerprint lock,” deeply integrating fingerprint recognition technology and AI algorithms, while achieving extremely natural movement and extremely accurate recognition.

Compared with vein locks, the “fingerprint lock” uses three-side recognition, which is more accurate and faster than one-side recognition; at the same time, it fully considers ergonomic design, so the finger can naturally recognize when gripped. The new “fingerprint lock” has an elegant appearance designed by Hartmut Esslinger, the chief designer of Apple II, with dual cameras, fingerprint unlocking, and structure light 3D facial unlocking, bringing users a more precise and secure home experience.

HUAWEI: In the first quarter of 2024, in the traditional e-commerce (professional e-commerce + platform e-commerce) price range of 3000-3500 yuan, HUAWEI’s retail sales and retail volume share both reached 46%, showing significant competitive advantages in this price segment. Since entering the smart lock field, HUAWEI’s smart lock series has always been committed to creating safe, reliable, and intelligent products with cutting-edge technology, protecting users’ home safety, and has won widespread recognition from consumers through continuous investment in technological R&D and marketing strategies.

This year, HUAWEI launched a new AI facial recognition lock, applying its own AI technology to 3D facial recognition, which not only considers the security and convenience of facial recognition unlocking but also brings a better experience as it is used more.

Kadis: attaching importance to the layout of new technology products, in the first quarter of 2024, in the retail sales structure of new technology markets in traditional e-commerce (professional e-commerce + platform e-commerce), it ranks among the top, among which Maoyan Big Screen (accounting for 15%), facial recognition (accounting for 19%), and vein recognition (accounting for 29%) are all in the first place.

Kadis, as a full industry chain company integrating product R&D, manufacturing, brand, global sales, installation, and after-sales service, actively embraces new quality productivity and vigorously develops intelligent manufacturing. The completion of the new factory in Wenzhou fully demonstrates the brand’s extreme pursuit of refined production intelligence and its firm determination to carry out scientific and technological research and development.

Growth has a way, scale development with the continuous advancement of technology and the growing needs of consumers, the smart lock industry will continue to maintain growth momentum. Forecast data shows that in 2024, the retail volume scale of household smart locks in China will reach 20.5 million sets, with a year-on-year increase of 9.6%; it is estimated that the online market retail volume scale will be 7.51 million sets, with a year-on-year increase of 15.0%.